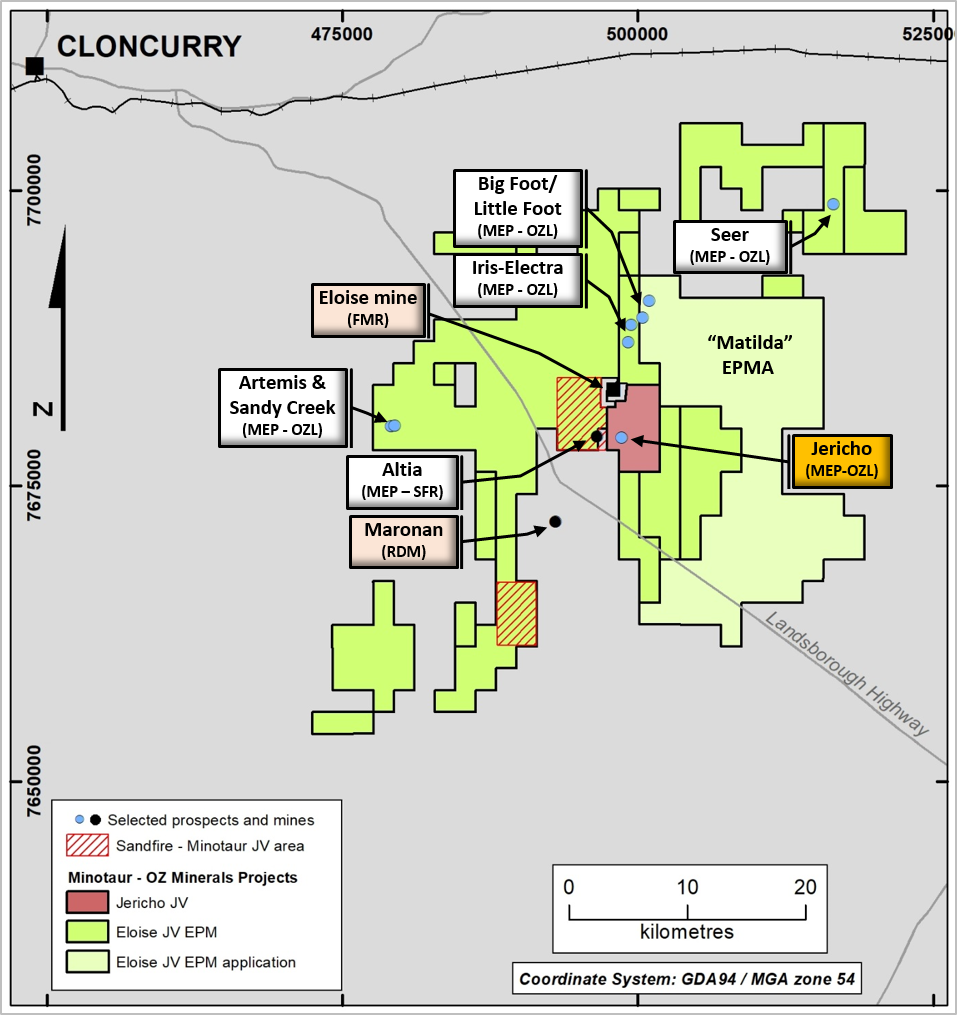

Eloise JV

EPM 17838, 18442, 18624, 19500, 25237, 25238, 25389, 25801, 26223, 26521, 26684, 26703 and MDL431; Minotaur 100% (except on those parts of MDL431 and EPM17838 where Sandfire Resources NL hold 60% interest), Area 766km2 OZ Minerals may earn up to 70% interest by expending $10 million over 6 years.

Minotaur’s Eloise tenements are subject to a farm-in joint venture with OZ Minerals Ltd (ASX: OZL). OZ Minerals is sole funding work programs and Minotaur is manager and operator. OZ Minerals achieved its 70% tenement interest early in 2019 through total expenditure of $10 million and will invest further $3 million by August 2021. For more information on the Eloise JV, click here.