Jericho JV

Jericho Copper-Gold System

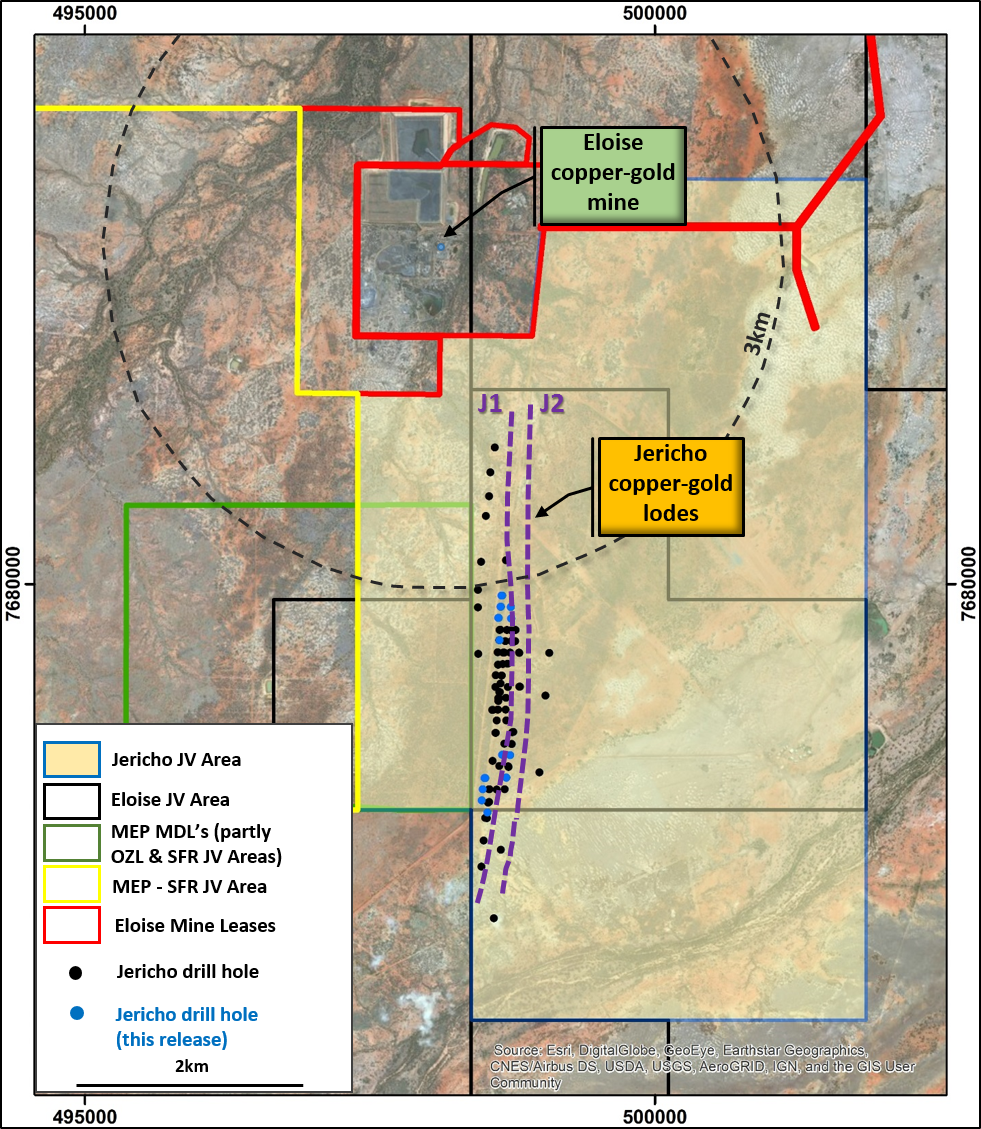

The Jericho EM conductor lies 3-5km south of the Eloise copper-gold mine (itself located 65km south-east of Cloncurry, Queensland), is hosted in the same shear zone, but had never been drill tested (it is largely invisible in all other datasets). Eloise mine, owned by FMR Investments Pty Ltd, has been operating for more than 20 years, mining from as deep as 1300m, delivering over 12 million tonnes of ore to the 700,000 tpa surface concentrator.

Drilling into Jericho’s EM plates through 2018-2019 by the Jericho JV (OZ Minerals 80% and Minotaur Exploration 20%) defined Jericho’s two main sub-parallel lodes (J1 and J2, about 120 metres apart). J1 has known strike of 3.7km and J2 has 3km of strike extent. 96 holes for 29,740m probed Jericho to 400-600m depth.

Jericho Mineral Resource Estimate

OZ Minerals produced a maiden Resource for the Jericho copper-gold system, on behalf of the Jericho JV.

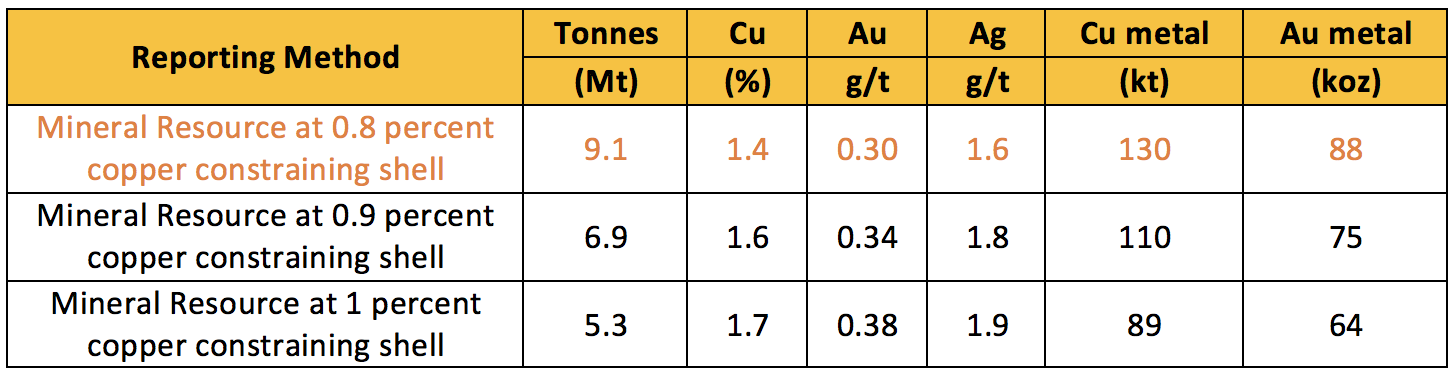

The Inferred Mineral Resource was estimated at 9.1 million tonnes grading 1.4% Cu, 0.3 g/t Au and 1.6 g/t Ag. (Table 1) within a 0.8 percent copper constraining shell. Estimates for tonnes and grade at alternate copper constraining shells are included in Table 1 for comparison.

The Resource encompasses about 2,000m of strike through the central portions of J1 and J2 lodes, dips steeply west and is open along strike and at depth. Minotaur’s considered view is that the system warrants down-dip and strike extent drilling to quantify resource extensions.

The Mineral Resource Estimate was reported by Minotaur to ASX on 16 July 2020.

Jericho JV Arrangement

OZ Minerals has sole funded all work on the Jericho project and its interest in the Jericho Joint Venture was set at 80% (Minotaur 20%) on 1 April 2019, from which time all activity continues to be funded by OZ Minerals. Minotaur’s 20% contributing interest from then onwards is treated as a non-recourse loan advanced by OZ Minerals and repayable only if positive cash flow emanates from commercial production at Jericho.